The most meaningful point in a movement’s life cycle is when it reaches the masses. That is the inflection point we all work towards—what author Malcolm Gladwell termed, “the tipping point.”

The seminal inflection point of the internet came in 1995 when Netscape went public, what many call the “Netscape moment.” That’s the day everything changed—when the internet went from being a plaything for hackers, researchers, and hobbyists to a legitimate mainstream network for ordinary people and industry. It was a day that helped spark the democratization of information, knowledge, and social connections.

Recognizing these moments is important, as they preempt an avalanche of adoption. In this piece, we are going to talk about how that moment has arrived for blockchain, the responsibility and opportunity that comes with it, as well as three key steps for what comes next.

1. Society’s generational inflection point

We are sitting at a generational inflection point at this moment in time. Wherever we look, the tide is shifting—evidenced by movements such as Black Lives Matters, Climate Change, and Wall Street Bets. These protests, fueled by social, political, and technological headwinds are grounded in values around inclusion, equity, and democracy.

Blockchain, too, represents many of the ethos of this new chapter. Think about Bitcoin—it’s open and inclusive; anyone can use it without relying on any intermediary.

We have witnessed this rapid change over the past five years—only to see it accelerated by the pandemic and influenced by a new generation of digitally native citizens.

Consider some of these milestones reached in just the past month:

- “Crypto firm Coinbase valued at more than oil giant BP” — That’s the BBC headline. From black gold to digital gold, this is the first time a cryptocurrency company has been listed and further validated by the public markets—just as Netscape had its moment in the 90s.

- The SEC approves sale and trading of securities on Figure’s blockchain — In another first ever, the SEC approved the trading of digital securities on Figure’s Provenance blockchain to facilitate consumer financial products such as equity, mortgage refinance, and student and personal loans. This is one of the top regulators in the country acknowledging that these new technologies are potentially safe and beneficial for investors. As of May 20th, the company is valued at $3.2 billion.

- MoneyGram provides last mile crypto access to immigrant families — Some might argue that this one isn’t a first, but in my view, MoneyGram’s decision to allow customers to buy crypto with cash or withdraw it from brick-and-mortar locations across the U.S. is one of the first times those who were intended to benefit from blockchain’s inclusion potential might actually have convenient access to it.

Back in January of 2019, I wrote that “blockchain will have its own Netscape Moment.” With Coinbase’s IPO and more, that moment has arrived. Not too shabby of a prediction.

As the NYTimes suggests, this is “crypto’s coming out party.” But what we’re really witnessing is the early groundwork being laid for the next chapter of technology and industry—powered by blockchain.

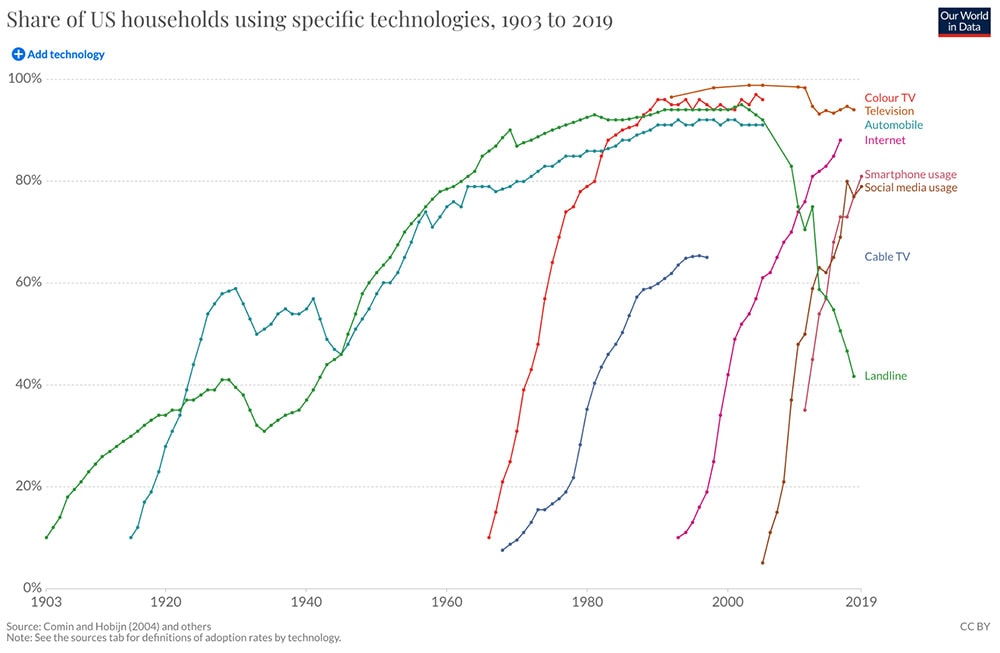

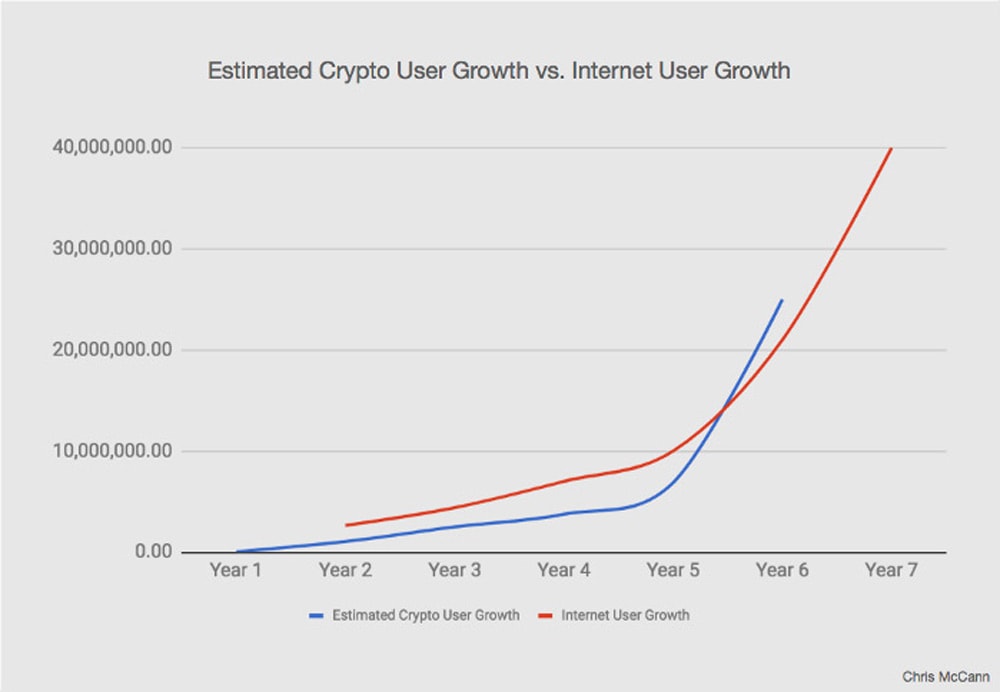

Many of us remember the internet’s Netscape moment. Netscape’s arrival on the world stage saw the beginning of mainstream acceptance and enthusiasm for the internet. From the advent of the World Wide Web, it took only ten years for one billion people to get online. Today, the rate of technological adoption is only accelerating.

And just as the internet ushered in an era of democratization around information, culture, and knowledge, blockchain, too, ushers in a new era of democratization of finance, ownership, and transparency—fueled by decentralization’s awesome potential.

Because like the internet, Blockchain is a foundational technology, and as such, has the potential to be just as disruptive. It’s about fundamentally changing the way companies and industries operate. Coinbase validated the notion of these assets being built on blockchains and traded. It also gives companies the currency—no pun intended—to meaningfully deploy blockchain as a legitimate technology.

If history is any indication—world beware—blockchain technology is coming. Indeed, it has already arrived.

According to Gemini’s 2021 State of U.S. Crypto Report, more than 21.2 million adults or about 14% of the U.S. population owns some form of cryptocurrency. Fun fact—in 1995 when Netscape went public, only 14% of Americans had internet access. By some estimates, crypto, in its 6th year of existence, could very well exceed the internet at the same age in number of users.

2. Game time!

What makes blockchain special? This is the first time we’re seeing digitally native value that can be transferred from one person to another without a central intermediary. If the internet was about the democratization of information, then blockchain is about the democratization of value.

The technology that underpins the blockchain is also unique. Its decentralized, transparent, and immutable nature can be leveraged to optimize operations across industries while presenting new frameworks for addressing traditional and novel use cases. And because blockchains are software programs, we can introduce snippets of code—known as smart contracts—to automate processes that historically required piles of paperwork and human verification.

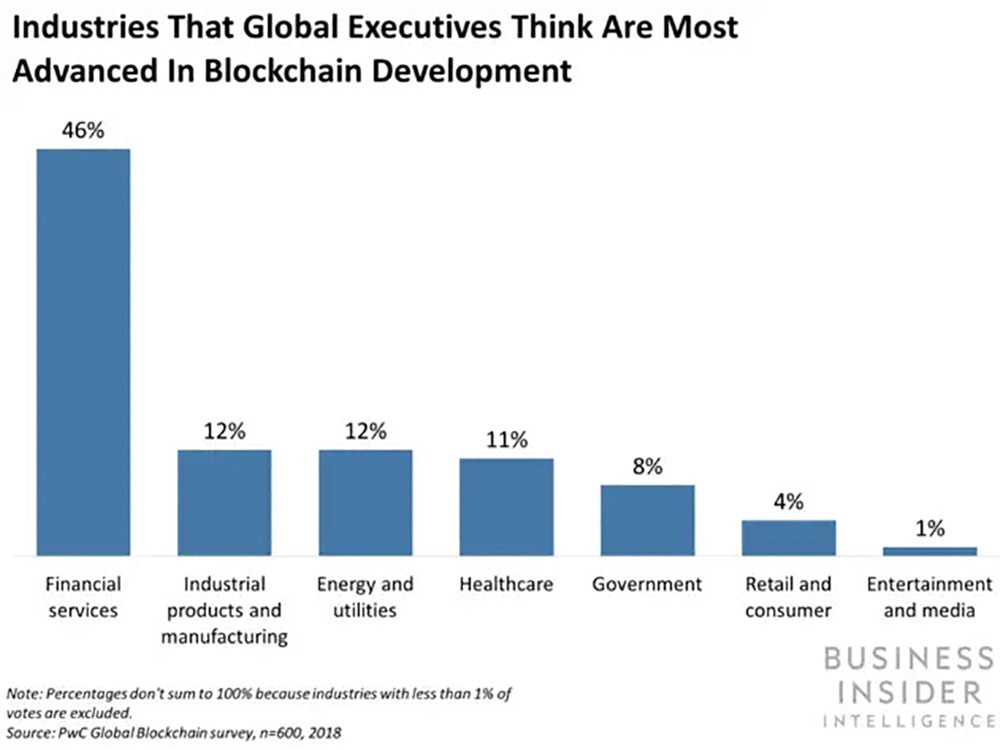

The result? From finance to healthcare to supply chains, blockchain has the potential to benefit industries across the board thanks to enhanced transparency, traceability, and authenticity.

Some stats, courtesy of Fortunly:

- By the end of 2024, it’s expected that corporations will spend $20 billion per year on blockchain technical services.

- About 90% of U.S. and European banks had started exploring blockchain’s potential by 2018.

- 74% of tech-savvy executive teams say they believe there’s a huge business potential in blockchain technology.

- 24% of companies expect to invest between $5 million and $10 million in blockchain during 2021.

- Financial institutions alone have spent about $552 million on blockchain-powered projects.

- More than 20 countries have adopted or at least researched the concept of a national cryptocurrency.

We’re already seeing companies like Figure—as we discussed earlier—offering consumer financial products with unprecedented convenience and speed at potentially better rates thanks to blockchain technology. We’re seeing startups like Origin Trail develop traceability solutions for organic beef, dairy, poultry, and vegetables—with blockchain’s immutable nature helping to verify food quality, source, and safety. We’re seeing established pharma companies like COVID-19 vaccine creator Pfizer explore blockchain’s potential through the MediLedger project, a closed ecosystem that will allow detailed tracking of drugs from manufacture to distribution ensuring authenticity.

But these are still the early innings.

We’re going to see companies reimagine the way we play, work, and connect. These companies will democratize access to fundamental services such as finance. They’ll enhance transparency around supply chains, governance, and digital identity. They’ll rebalance power towards individuals, giving them back ownership and control. They’ll create trust with each other, with the businesses we patron, and with our institutions that we rely on.

We’ll see new frameworks for voting, healthcare and medical records, content monetization, and ownership of things. It means new consumer expectations around speed, security, and convenience. It means government involvement—including their own version of digital money—as well as new regulations to protect us and foster innovation.

3. What’s next for blockchain?

Back in 2019, I wrote that this moment would “allow companies to develop transformative products, such that blockchain becomes just another back-office IT decision.” Right now, blockchain represents an innovative new technology and a new framework for solving old and novel problems. That can be a challenge for slow-moving, legacy incumbents. But it also represents an opportunity for nimble organizations preparing for the future.

For blockchain to reach its potential and empower bigger changes, it needs to be understood as a viable option with unique benefits for any company in any industry.

That moment has arrived. Here’s how blockchain plays out from here:

- Disruption — A new generation of companies are arriving on the world stage—with Coinbase and many others leading the charge. Some will leverage blockchain’s features to enhance existing models. Others will introduce new and disruptive frameworks that will wildly rejigger our expectations. We start to see mainstream acceptance.

- Enterprise and SaaS adoption — Eventually, companies across industries will leverage blockchain as part of their enterprise tech stacks in order to reduce costs, enhance efficiency, and provide better offerings—in part due to evolving consumer expectations. Enterprise software-as-a-service (SaaS) solutions will implement blockchain technologies as well as digital assets across capital markets, payments, lending, and asset management. Every company is a software company? Now—every company is a blockchain company.

- Verticalization — Much like the early innings of the internet, we’ll see plenty of entrants vying for a foothold in a blockchain-powered future across numerous specialized use cases. As the overall industry grows, we’ll likely see a shakeout and consolidation around core verticals, reshaping the tech landscape with a new generation of heavy hitters.Netscape helped spawn countless companies vying to be part of the internet narrative. Ebay made e-commerce real. Google made search monetization real. Paypal made fintech real. Facebook made social networking real.Ebay, Google, Paypal, and Facebook made the future real. And now it’s happening all over again.