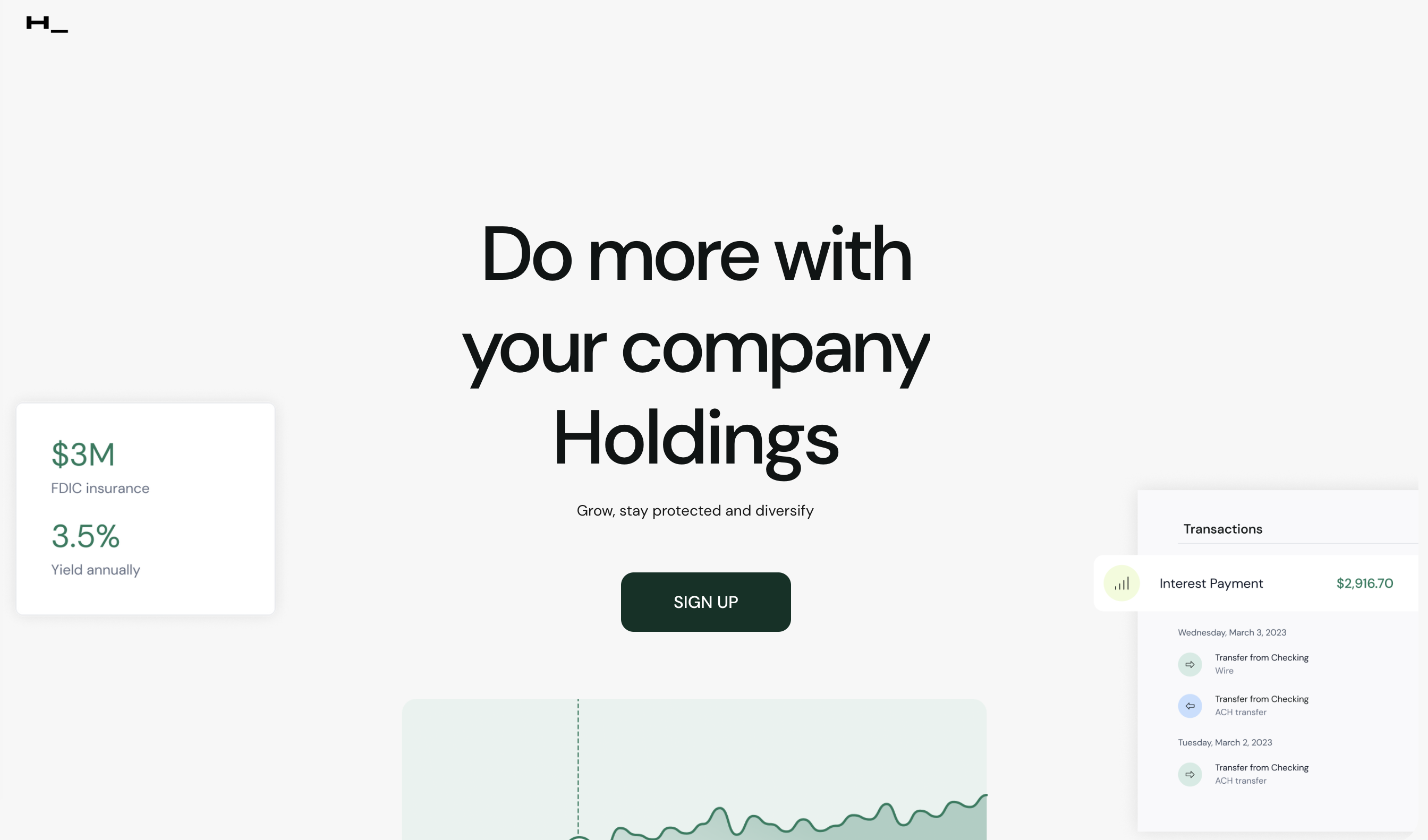

Announcing Holdings

The risk management platform for businesses to diversify, protect, and grow their holdings.

The last 72 hours have been a whirlwind.

Companies rushed to find a new, trustworthy primary financial institution. Some flocked to the largest banks for safety. Most repeated the same mistake as before—they concentrated all of their cash at a single bank.

We’re experienced fintech operators who have wanted to fix this problem. That’s why we’ve been working for the last nine months on a solution.

We’re excited to announce the official launch of Holdings, the risk management platform for businesses to diversify, protect, and grow their holdings. Yesterday, we started onboarding the many businesses that have already signed up. Join us at Holdings.io

Our first product is a cash account provided in partnership with Evolve Bank & Trust, Member FDIC, that works alongside your primary bank account. It provides up to $3M in FDIC insurance—12x the average, while also providing a 3.5% annual yield. We offer Same-Day liquidity by ACH, unlike the traditional 3-5 day wait for yield-generating accounts.

Holdings spreads your cash in $250K increments across different, trustworthy financial institutions. In the future, we’ll help you diversify into other assets as well.

We don’t want to be your primary bank. We don’t want to disrupt your day-to-day banking needs. Instead, we want to complement your existing banking partner and provide you with the tools to easily get the most out of your idle cash. We partner with trusted financial institutions, including Goldman Sachs, Stone Castle / US Bank, Zions Bank, Capital One, Evolve Bank & Trust, and others.

We’ve been building in stealth since July 2022 and have raised $4M from Album VC, Fin Capital, and others. We understand these problems intimately. Our founder Jason Garcia spent the first half of his career in banking at Goldman Sachs and as a Senior Vice President at SVB. Later, he became the Head of Business Development at Divvy (sold to Bill.com for $2.5B) and the VP of Capital at Mercury. The rest of the team has also spent time at Wex and Clearco.

Companies with less than $50M in cash deserve access to the same assets and financial strategies that the largest institutions use to diversify and manage risk. We want to level the financial playing field for every business.

Sign up at Holdings.io

SOURCE: Holdings